In a nutshell the FDIC is out of money and is asking the banks to pay their fees early so it has reserve cash on hand while at the same time allowing those banks to not put those early fees on their books yet because it would probably make them legally insolvent. I see a paradox here.

LOL. EPIC.

the FDIC can’t run out of money by definition because they can go to the treasury (but this is something that they have proudly never needed to do). The can set the size of the reserve fund and cost of the fees. So instead of raising fees (yet) or printing money they are doing the banks a favor by asking for payments up front which is cheaper for everybody involved.

makes sense to me.

I think you missed the part where they are not making the banks report the early fees on their books…

^this.

Edit. theblue.

Penfold, I didn’t see that in the article, and I just skimmed it again… please quote it for me.

Well god damn. They took that part out when AP added to the story in their last update.

I swear it was there.

:tinfoilhat:

You guys REALLY hate our financial system.

Dont fear, I searched the interweb and found an un-updated version!

This scenario would be the best because it gives the FDIC billions of dollars upfront, while banks would be able to delay the earnings hit because prepayments can be accounted for in increments over time instead of all at once.

Just certain parts of it.

Joe. I don’t hate it…I regret not knowing what I know sooner. I regret not being born earlier as well so I could benefit from all the early inflation. We younger folks are in a predicament of epic proportions and never had the benefit of the early economy.

Do you think it’s a sound and realistic system to allow fractional reserve lending and bailouts the way they have?

I love bailouts. Our banking system didn’t collapse and the government is profiting on loan interest. What’s not to love about the fed rickrolling a liquidity trap? :carnut:

The go’ment is “profiting” some say? So while they “profit” and expand their piss poor management practices and go’ment spending, we (the working class) will lose spending power due to inflation. Yeah, sounds like a GREAT DEAL to me as consumer. We can work harder and longer to attempt to achieve the same quality of life we are used to. YAY!

I still cannot believe people are tooting the go’ment profiting horn. The go’ment is grasping at straws and the clock is ticking. Debt can only be used to create so many derivatives of itself before the shit hits the fan. Maybe a collapse or dismantling won’t come about in my time, though I can’t say that with a straight face. At some point all fiat returns to it’s true value which is 0, the question is when and how much will inflation hurt the middle class in the process.

Wealth re-distribution is the game being played. Those with absolute faith in the USD and our paper markets will be crushed when the big boys decide there’s a better game out of town. 401k, mutual funds, blah blah blah. Not many have a clue when it comes to true real world financial stuff, even the highly educated people. A book can only teach you so many equations, the true economy is something bigger than any book could teach.

People have been saying the same shit for decades. There were quotes from conservative economists almost verbatim to what you just said when FDR spent our way out of the Great Depression and that worked out OK.

Joe…like I said…it’s a matter of WHEN. The timeframe would seem to speed up IMO if you allow massive bubbles and do NOT allow proper deflationary bear periods.

Who knows when, or I suppose even if the shit will hit the fan. All we know as fact is inflation is essentially a constant since they won’t/cannot let things deflate. So our dollar is constantly being diluted and we are being robbed of spending power all along the way. Nifty.

The US great depression was a DEFLATIONARY depression. There are also inflationary depressions (Germany was the most notable) where the currency works it’s way to worthless.

You’re educated…surely you realize you cannot compare the past to an era of 1971-Current where there is no gold standard. The dollar used to be a derivative of GOLD where as it’s now a derivative of DEBT. I’m sure I could learn alot of stuff from you on this stuff, so don’t take this as arrogance or fighting. I’m enjoying the chats I have with people like you alot and learning stuff along the way.

I would have to say…until we are sheepish enough in the US to not revolt and/or another country has the means to take over as world power we will be stuck on the exponential inflationary curve. You have to admit that wages in the US are so far out of whack compared to production value. You’re a FA guy, can you honestly give the US a thumbs up fundamentally???

I would comment but I am pretty much in complete agreement with TradersBASE.

Bring on the economic doom! I’d rather live long and poor than short and rich.

Why do people get healthier in depressions? “If you want a short answer, I don’t know,” Tapia Granados said.

There are many possible reasons. People smoke and drink more when times are good, and there is money to spare. Traffic accidents, industrial accidents, work hours and work stress all go up when the economy is booming.

“It is increasingly known that over time, stress in the work place can increase the risk of things like heart attacks,” Tapia Granados said.

“There are other possibilities which are speculative,” he added. “Many people believe that the Depression was a period of social support. When you are at risk of losing your job, you get much more connected with members of your community.” Social support seems to improve health, he said.

http://dsc.discovery.com/news/2009/09/28/recession-health.html

The FDIC SHOULD go after the banks.

The banks convinced the FDIC NOT to collect premiums in the past 10 years. These banks should have been paying premiums in the past 10 years. Get the money from them now.

This very nearly was a deflationary depression. The CPI was falling like crazy until they stepped in. I don’t think we see a Weimar Republic type incident simply because the world puts their full faith and credit in greenbacks. Call it a ponzi scheme but when our debt falls in value, bargain-seekers worldwide step in and bring it back up. Tons of 3rd world countries out there that are growing would rather use our currency than their own. Everything comes to an end and that may someday, but I don’t think we see it in our generation.

As for our competitive advantages fundamentally, it all depends on your product and process. First, American English is the language of the digital era, and native speakers will all have an advantage. Second, we’re the biggest market for nearly all consumer goods and services, and you need Americans to market your product to Americans. That’s why you see Toyota using the burly Southern guy voice to sell their trucks. Third, we know how to play the game. There will always be an advantage to Americans running the business to grease the wheels of the government and who to pay off, what lobbyists to hire, and how to get what the company wants. Also, the service industry, even though it sucks, but most of the more customer interactive jobs pull a premium on American labor. Not so much the maid that cleans your hotel room, but certainly the guy who checks you in. These are all from the corporate end of things. As for manufacturing/production, on a fundamental basis there are certain things we can compete on, and certain things we can’t. How many times do you hear of a local shop ditching their local suppliers to go overseas for machined stuff or metal or basic materials, only to have to come back when the offshore stuff doesn’t meet tolerances or specs?

It all depends on what you’re making. For cheap plastic shit where the guy just needs to press a button on a machine, sure, that belongs overseas. But for advanced stuff with close tolerances, labor cost is well worth it to get things done right. If you are competing from a quality perspective and pulling a premium, the American labor market is fundamentally sound, especially since wages are going down. That’s why Intel just spent 7 billion on new US plants after they’ve gone pretty much everywhere in the world with their manufacturing.

In the future, it probably sucks, but I see the US labor market with the manufacturing jobs replaced by specialized, more skilled manufacturing, service jobs, particularly in health care and education and financial services, and corporate america.

Cliffs: Some stuff is worth the premium on US labor. Other stuff isn’t.

I agree with ya on most that stuff. We did in fact almost have a proper (and IMO much needed) bear deflation period. It was SOOOO close. When I said they can’t/won’t let it deflate…WON’T is more accurate IMO. Like you said though, as the US goes…so does the entire world economy more less. If we have a full depression so will the other countries. If some manage to show strength their exports will be too expensive and they’ll end up battered eventually. This is the power the Bretton Woods brought to our table here in the US. With essentially everything “pegged” to our currency we have absolute power. A power we have abused horribly. Or should I say the rich bankers coerced us to abuse. We are merely puppets on a string.

You’re dead on…in our recession the US wealth AND foreign wealth stepped in heavy. Compared to recent prices (TA wise) we were at a bargain prices on many things. I’ll ask again tho, FA wise can you stand behind the US and it’s balance sheet? I’ve never done a real balance sheet and I’d be interested to see what you come up with since you have formal training and I don’t. Buying because you HAVE to is far different that buying because you WANT to.

Setting TA and FA aside, here’s the reason IMO why foreigners are buying shit up here. In part like we said…everything is “pegged” to the US and they don’t wanna crash along with us. But also with the newly flooded money supply practically EVERYTHING (staple of life wise) will shoot up in value. We have far more dollars chasing the same goods. They don’t want to have USD on hand, they want to have goods that people will buy with the USD. If you save now you are a fool. USD will be losing ground in terms of spending power. INVESTING is far different than saving on something lame like a CD or bank instrument. You know this…but how many others do?

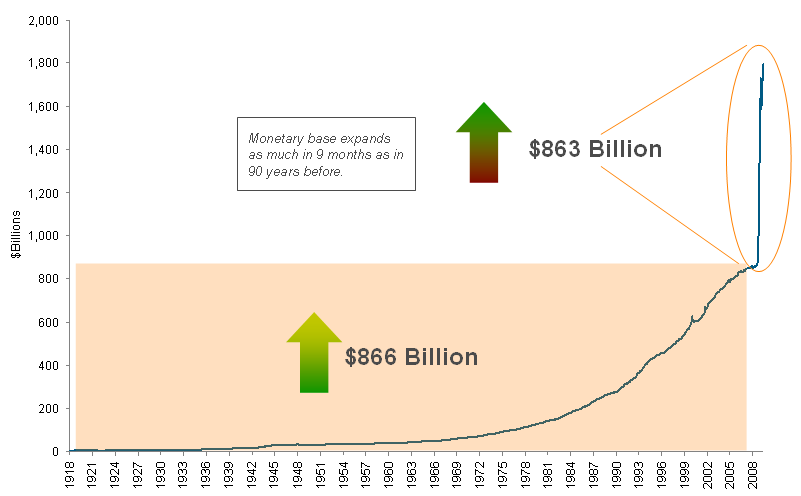

FAR MORE DOLLARS!!!

I am out of the tech loop since I was let go last year. I didn’t know Intel built a US campus. I bet Intel bought here in the US for a few big reasons…and IMO quality of labor is NOT one. Appreciation of the property would be a major reason I would assume. Also, they have an interest or stake in the fire. WE are the people buying their computer chips and if we die so does their market. Again, it’s out of necesity not desire IMO. Inflation can and will continue to create and transferred MASSIVE amounts of wealth. The concern I have is the wealth flows from those that do all the work (middle class) into the hands of those that do nothing (wealthy). I understand the biz are the ones taking risk and they need to profit, but after taxes etc… we are slaves to the system. We as consumers are so debt strapped we NEED these jobs and we NEED the pay rates to continue rising just to cover interest. Everybody is strapped with leveraged liabilities in the US…that is a concern of EPIC proportions to me.

Are service jobs really worth $30+ an hour? I guess technically we could be paid $1,000 an hour and something like a loaf of bread could be $100. If they can continue to raise wages in pace with inflation then the bubble could grow and grow and grow in theory.

The chart Traderbase posted is the key factor to all of this.

That is all.