any of you boys have a local gold/silver bullion guy in WNY?

My neighbor works for Jack Hunt.

can you just walk in and swipe a visa and walk about with bullion? i’ve never done it before

just looked at thier site…lol

those mason mint .45 Cal bullets are amazing…lol

assuming they are cheaper w/o ebay fees

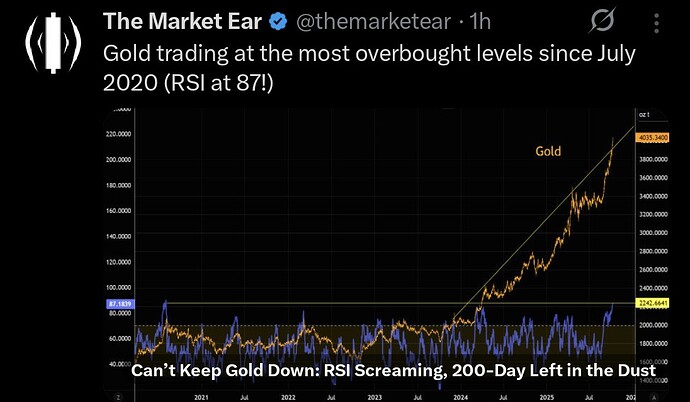

Bro are you buying at the top?

yup. things are quite toppy but I also think if you dont buy the high you’ll just be buying a later high.

silver dipped almost 3% in the last 48 hours and it already got bought back up.

I really just want to spend a couple grand and get stuff that will be interesting to give to my sons to hold on to

@bing He said cash you can walk in and walk out with anything you want. Certified bank draft it’s a 5 day holding period. No credit cards, the margins are too small.

Now I did hear something about Credit Suisse making a change, which is the real driver of the run. But we’ll see.

its correcting a bit today and the stocks are pulling back as well but no biggie.

Everything seemed a little hot.

gold bounced right back… as did silver. we’ll see what monday holds.

i have a feeling this is going to go on for a long while.

Healthy pullback. Use the news to clean house. I’m already shopping for discounts ![]()

Gold went from $4k to $4,300 in a week… good but not good.

i never really followed BTC or anything else this closely but i have never seen a bull market intensify like this… even Jamie Dimon says Gold is going north of $5k to $10k this week…

alos,

https://www.reuters.com/business/bofa-lifts-2026-gold-forecast-5000oz-sees-silver-65-2025-10-13/

i did here some pretty smart insiders on another podcast tonight talking about an overdue pullback but even then they are only saying 10% pullback to rebase and run again…

i now have my second multi-bagger of the year in this, another 2 over 50% and climbing.

oh i agree.

i’m not buying the metals (other than some token items), i’m buying the mining stocks and thier Q3 earnings all hit over the next 2-3 weeks. last Q was $2500 - $2700/oz in rev. Q3 should be over $3k per ounce so plenty more catalysts.

also, today is a big correction (4% - 8% on many tickers) but if Gold continues this uptrend towards $5k in 2026 then everything should keep on keeping on.

Interesting…

JP Morgan sees gold prices averaging $5,055 per ounce by late 2026 | Reuters https://share.google/gbNKi845HSKylmsoQ

Been quite the ride this past week.