the sunny weather? shit…

the great night life? shit…

the beaches? shit…

the job market? shit…

the local economy? shit…

the housing market? shit…

the great schools? shit…

the casinos? shit…

LOL, what this guy said.Except the schools really are great by comparison.

the margin is closing though.

:gotme:

Shit housing market? If by “shit” you mean decent place for dirt cheap, then yeah, shit.

Whatchu talkin bout Willis?

value growth.

inventory.

tax rates.

that shit burns me up. I cant believe the tax rates around here and waht some people consider “cheap”.

YTD Taxes Pd$1,810.48

Yeah, well, welcome to The People’s Republic of New York.

deep fried christ on a stick

best part is that my town assessed value is like $53k.

of course the 500sq ft addition is also technically a covered porch. :snky:

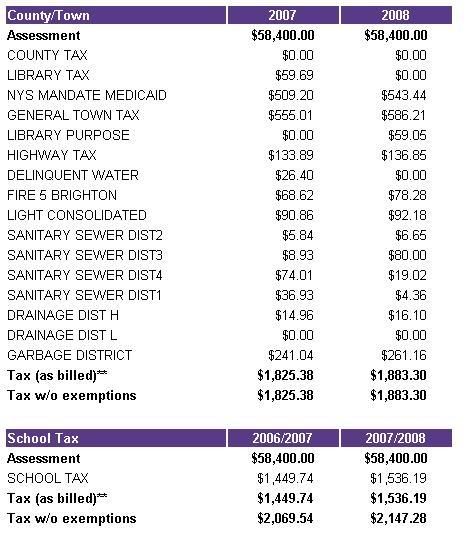

My house:

For those who can’t view PB, it’s a breakdown of my property and school taxes, which add up to $4300 for the year (without exemptions). In the Ken-Ton school district. And <2000 sq ft house. With 0.182 acres of land.

so ytd almost $2k on an assessed $53k? fuck me sideways

my rents house out in ea hasnt been reassessed in 25 years. They are paying ~$4k+ on an assessed $65k. I cant imagine what it will be if they sell it.

yeppers.

Total bill should be right around 2500 not counting what I donate to the 3 volunteer fire companies around us.

It’s only a matter of time before we get reassessed - the prev owners were elderly and had all the exemptions in the world before we bought it last April.

Then of course we filed ~$50k worth of rebuilding permits in June.

So long as it comes in well below the bank appraisal I’ll be happy. :meh:

Oh yea, Amherst Central school district.

Fry that seems really high. Here is mine in the Amherst school district.

Total Assessed Value $99,000

Town and County (click for detail) Current Collection 2008

Bill Amount $1,777.11

School

Collection 2007

Bill Amount $829.02

Exemption Amount $1,115.84

True Tax $1,944.86

Mine would be $3700 a year without exemptions, on 99k value.

Yeah I dunno. That’s just a screen cap from Tonawanda’s town website for my house. :shrug: