Okay, ever since I posted the link to credit boards and got into some discussion regarding procedures and the possibilities of repairing near rock bottom credit, I’ve gotten a lot of PM’s and messages on AIM for help. I’d love to help everyone individually ( so if I don’t get back to you I’m sorry ) but I think it’d be better if I just posted some general information here that should get you/everyone on the right track.

1.) Sign up for your new best friend: [U]Credit Board

2.) Get copies of your credit reports from all 3 reporting agencies. These are the links you need:

Transunion.[/U]Click online, then if you’re new, click new, or returning, click returning. Log in. Then at the top, under the tabs, click ‘transunion credit report’. Then click order now.

Experian. Click the $10 link.

Equifax.Make sure you UNCHECK that ‘best deal’ crap to get your score included for $15.50, it’s pointless. The only score that matters is FICO…all the bureaus have are fake ones. Just get the $10 one.

pulling these reports will not negatively impact your credit score

3.) Once you are registered, print out this list, you’ll need it in the beginning to help your head from spinning. Credit Glossary

4.) Opt-out. There are a million benefits, and even if you don’t care about credit repair you should be option out. The explanation of what it is and why you should do… and how you should do it… are Here

5.) Read and Print out the PsychDoc Transcripts. He is very experienced in credit repair and almost all noobs are referred to his transcripts to help give insight and understanding. I read and re-read his instructions and discussions multiple times. After going through them I felt a lot better about fixing my credit… and felt like I had direction. You’ll feel the same. PsychDoc’s Transcripts.

That should keep you guys busy for awhile! Good luck, it’s a long journey… and just know ANYTHING is possible! Oh… one last link… if you need motivation… there is a success stories section of the forum that always inspires me to read more and work harder towards repairing my shit. You’ll read that your problems aren’t really that big of a deal…  SUCCESS!

SUCCESS!

You can always PM me or hit me up on aim or email if you really are still confused~!

~adam

THIS POST HAS LINKS TO CREDIT PRE SELECTOR WEBSITES: http://nyspeed.com/forums/showpost.php?p=1212844&postcount=94

edit:

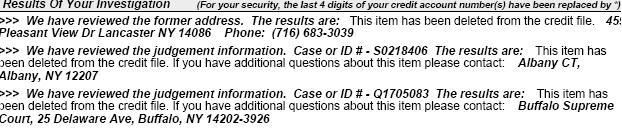

Credit repair works!

edit2:

Credit repair really works