WOOT WOOT

credit repair works, and is worth the effort

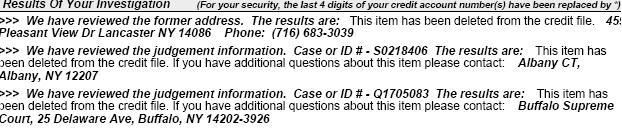

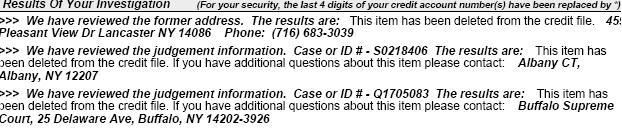

my 2 judgments have now been removed off 2 of the 3 credit reporting agencies. GO ME

WOOT WOOT

credit repair works, and is worth the effort

my 2 judgments have now been removed off 2 of the 3 credit reporting agencies. GO ME

Guys, I have my very last CC payment coming out on the 20th of this month. After that payment I will only have the neccessities like car note, car ins and cell. With my dad being sick and him going into a nursing home for good, I really need to get my score up. Any quick ways to do this??? Will good will letters work?? can I just dispute online and that will clear it up or what?? I would really like to get my score up asap so if case the state does try and come after my dads home, I can try and buy it or something. Any tips is greatly appreciated. I know creditboards is a great help but it seems like I only have free time at work to look at the site and I cant at work.

I’m sorry to hear about your pops.

What are the main “baddies” on your reports? If they are late payments, I’ve had zero luck disputing online, and a little better luck using good will letters to lenders.

I have however, have moderate success with disputing online in regards to other things. You may even want to try calling the companies and pleading your case with them, I guess it all depends on your timeline.

I guess tell us / pm me your credit score and a brief overview of your report. I don’t know much about mortgages, but I don’t think they are as hard to get as you might have thought.

LMK, good luck

-adam

Sucks to hear Dave, sorry man.

From personal experience, and I’m no expert: if he is going to go to a home in the near future, and if he is going to need medicaid help for the home expenses (the cheapest asssited lvg place we found that wasn’t an abuse center was ~$125/DAY), you need to get his assets straightened out now.

IIRC, any assets in their name will need to be liquidated down to an acceptible amount (i think that was something like $6k) before medicaid will kickin. Meaning that once his private & insurance funds stopped covering the care facility, you’d have to sell the house & any real assets to cover the facility until you’ve spent down to the medicaid limit.

This is all rough memory from ~3 yrs ago, but if you want I can give you specific examples. Gimme a call sometime, tonight or tomorrow afternoon.

As far as this thread goes, there aren’t many “instant fixes” for FICO that haven’t been covered here - though, I’m not an expert on credit repair.

As far as the mortgage is concerned, very rough estimate to get a mortgage: 45% DTI, 580+ FICO, 97% LTV if you are 1st homebuyer program. 3% down pmt & closing costs are covered by a 2nd (unsecured) loan.

If not first time program consider more like: 45% DTI, 600+ FICO, 85% LTV. 15% down pmt & responsible for closing costs.

Thanks guys. I am gonna check over this post and credit boards this weekend. I still have to pull my reports and look them over. I will pm you my info.

Nick, have u ever heard of Summit healthcare??? My dad has been admitted to the Waterfront healthcare rehab center for a permanent stay. Hopefully this will be short term as we really would like to move to GA.

went to myfico.com and signed up for there trial offer. score is 585 thru equifax ouch.

I have 8700 worth of revolving credit, 6500 of that is my dads chase card. I am just the authorized user. I am going to get my name removed and then that will be removed. Same with my dads HD card. 713 bucks. I also have 13XX.00 that should come off from Cap one when I make my last payment to the collection agent on the 20th of this month.

so after those 3 things are removed, only thing that will show on my credit report as revolving is my car note. I have 2 things come up on my TU report that I should be able to get cleared up ASAP. a ni mo bill and something for taxes. But I have never had a Ni mo in my name and I always pay my taxes.

So my question is this, If I was to call and try to convince someone to remove these late payments/bad history, who would I ask for?? and would it hurt to call and send a good will letter??? also, who do I send the GW letters too???

baddies include

HSBC/zales which I took a settlement offer for and is pd

HSBC CC which I took a settlement for and is pd

dell account which is pd in full but has some late payments

wa mu cc which was charged off and pd in full

cap one, will be paid in full thru a col agencie this month. I know I will have to give them time to report back to cap one that it is pd.

sorry for all the repeat ?'s, i am gonna dedicate sometime this week to credit boards and internet research.

Does revolving credit card debt hurt my credit more than a loan? I have a few high interest credit cards, and i’m wondering if a student loan would be better on my credit score than all the CC’s.

I’m pretty tired right now, but I just wanted you to know I saw this, and will get back to you later tonight or sunday morning.

There are many here who are much more knowledgeable regarding finances, and they will undoubtedly provide you better/more insight regarding the idea of where your debt should lie, however I can provide you with this advice regarding credit:

Revolving credit has a much more volatile effect on your credit score than “installment debt.” If you are maxed out on your revolving credit, like store credit or credit cards, your score is definitely taking a big hit. With such a high debt utilization %, other lenders will have a much easier decision in denying you future credit.

Installment debt like school loans are hardly ever considered into a lenders decision to grant you a trade line, as most people do have school loans, and those amounts are usually very high. Now if you were late paying the installment debt, that’s a different story. Your credit report will display the installment payment however, so if you were to try and get an auto loan or something, the lender would take that monthly payment into consideration when calculating your DTI% ( debt-to-income ). For more information regarding that, see Nikuk’s loan thread here: http://nyspeed.com/forums/showthread.php?t=42786&highlight=nikuk+loan

Furthermore, you are likely to get a better APR on the student loans than the creditcards. That alone should help you with a decision. Anyways I’m tired, bbl.

-adam

No prob adam, whenever u get a chance

my wife currently has bad debt for different reasons. medical bills, 1 year overdue capital one bill they tried to settle but we couldnt afford the offered amount at that time. and we need to know what may be our options to fix the long term damage and fix the past trail? most debts are within the last 18 months.

my score is currently 666 :meh: but going up as i have the oppertunity to pay off all 5 cards that are all near limit.

Your debt sounds fine, her’s may be a problem. It looks like you are going to be spending a lot of time reading about HIPAA. Since I don’t have any experience with this, I’ve never spent anytime learning about it. Sorry…

But I can point you in the right direction. If you are serious about fixing the problems, then you won’t have a problem reading this: http://creditboards.com/forums/index.php?showtopic=141352

And then reviewing threads in the “medical discussion” section of that forum.

Good luck

If you want to pull your credit reports for free, without using any annual credit crap… use these links. They are essentially “backdoor” methods of getting them.

Transunion: http://annualcreditreport.transunion.com/tu/disclosure/currentSituation.jsp

you dont need a legit denial of credit to get them?

Nope, but you can only pull them once a week this way, otherwise you have to call the agencies and get it for free that way. Since our society ( myself included ) is generally against formal interaction, pulling once a week is just fine.

awesome, thanks :tup:

Adam,

Im a authroized user on my dads CC’s. Well as I stated above, madicaid is taking all of his pension and SS. Im not in the place where I can pay his bills and buy my house all at the same time. The problem is that some of the CC’s have become delinquent(sp?) How can I go about removing myself as a authorized user to up my credit score? can I dispute the claims?? I doubt I can call them ask to be removed since my dad owes them cash. Im completely debt free, but being a AU on my dads accounts, I have 15K of debt hanging above my head

You can call and be removed as an authorized user. You might have to lie and say you are your dad though… but coming off as an AU is no problem… and I would be doing it ASAP since he is getting lates… I’m sure it’s butchering your credit score!

If you weren’t an AU and instead the account had dual ownership , your father and you, that’d be a different story.

do they have the right to refuse the request since money is owed and payments are behind?? is there any law stating that they have to remove me as a AU???

Are they refusing you?

Unfortunately, I’m uncertain what the law specifically states regarding AU

Adam,

I disputed a few of my dads accounts and according to my results, 4 things have been deleted but when I log on to transunion, the accounts and balances still show. should these come off ASAP and my score jump up?? I mean I disputed 16K in accounts.

also, I paid a lil extra thru transunion to view all 3 credit reports. It looks like when i disputed the item, it only took care of transunion. DO I need to pay for credit monitoring with experian and equixfax and dispute online with them as well?? I gotta get this score up quickly, I need to make a move on this house.

Thanks Adam for all your help