plenty of threads on here on this topic but I need some other clarification.

I had some, let it lapse, in hopes my employer was going to offer it in the form of a raise since I will have been at this company 3 years in January.

That has slowly, ok blunty, been stated as not the case. So until I find something that will pay for my hard work and offer some benefits (probably going to go to school for something, have really considered the Line Work program at ECC…but i really don’t want to sell the bird right away), I need something to hold me over. However if any of you need home improvement work done, the company does great work, and a building spree could change his mind?..ok doubtful.

For how small the company is at this point (1 other full time employee, myself, 2 brothers as owners and the son) and the extra time and help I’ve done, I can see why Obama wants to slap a penalty on small businesses like this.

Heck they use the “banked” overtime system, and only once did I actually recieve time and a half for working over the clock. The only positive right now, at least I’m working.

I need some answers from the health insurance guru’s on here.

I need to know what to budget myself at.

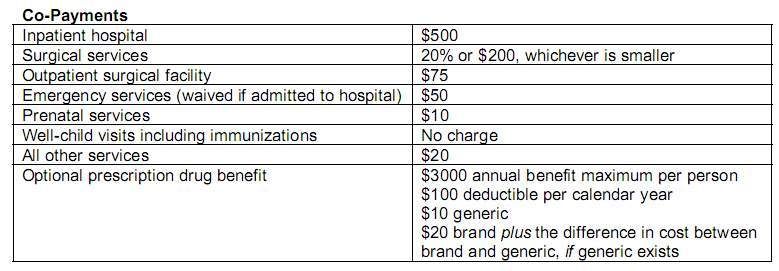

Healthy New York looks to be my best bet at around $170 a month (no problem affording that). I guess there are several major companies that offer the “healthy ny” policy. My question, why do the prices vary so much by carrier for the same package and care?

Does anyone know of a policy, similar in price, that I can get w/o bothering with the Healthy NY stuff.

Mainly I want health insurance for the unknowns. I could be at home and I let the sawzall get out of hand…or a jackstand kicks out and takes out a testicle…Cancer! That kind of thing.

Should I just hold out until Obama’s idea gets passed in some form or grab it now, that could be till next year I suppose before they get a happy median.

Rock and a hard place, Rock and a Hard place. Internet bitching actually feels kinda good.